The cannabis industry in the United States and Canada continues to undergo a significant period of consolidation and rationalization, as evidenced by licensing data from the third quarter (Q3) of 2025. The overall trend across North America is one of contraction in both active license counts and new market entry pipelines, signaling a maturation of the regulated cannabis sector following the explosive growth of earlier years.

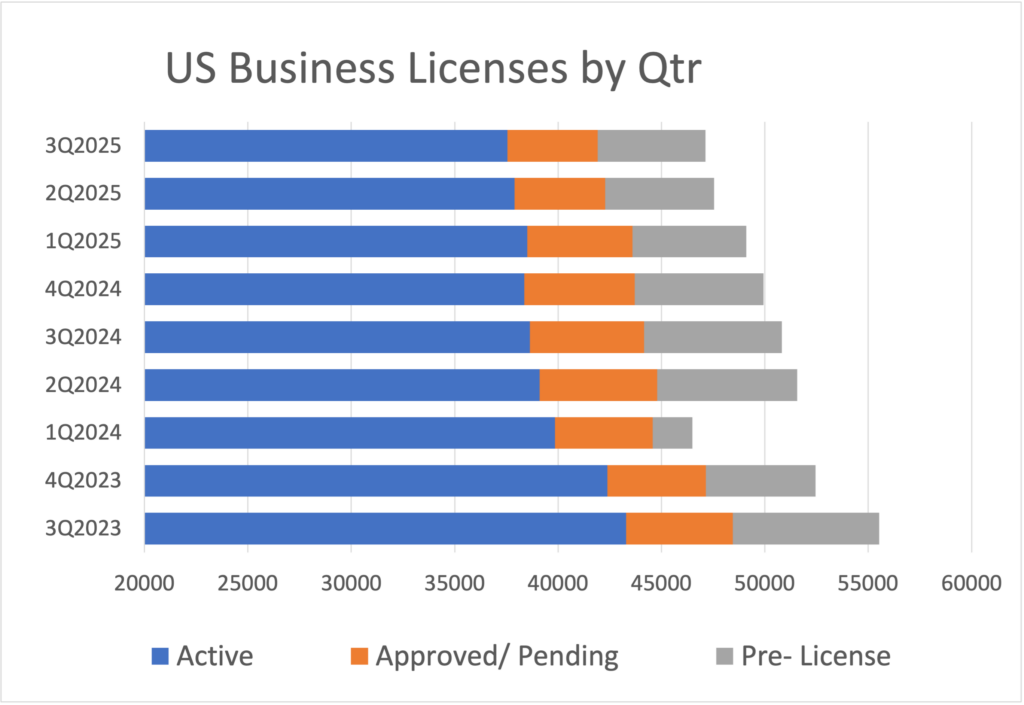

The United States saw a 1% decline in total active business licenses, falling to 37,555, marking a continuation of a multi-year decline that began in late 2022. Over the past two years, the national active license count has contracted by 13%. Similarly, the pipeline for future growth—encompassing approved/pending and pre-licensing applications—also weakened, with consecutive quarterly declines highlighting increased market caution and saturation in established regions.

The United States saw a 1% decline in total active business licenses, falling to 37,555, marking a continuation of a multi-year decline that began in late 2022. Over the past two years, the national active license count has contracted by 13%. Similarly, the pipeline for future growth—encompassing approved/pending and pre-licensing applications—also weakened, with consecutive quarterly declines highlighting increased market caution and saturation in established regions.

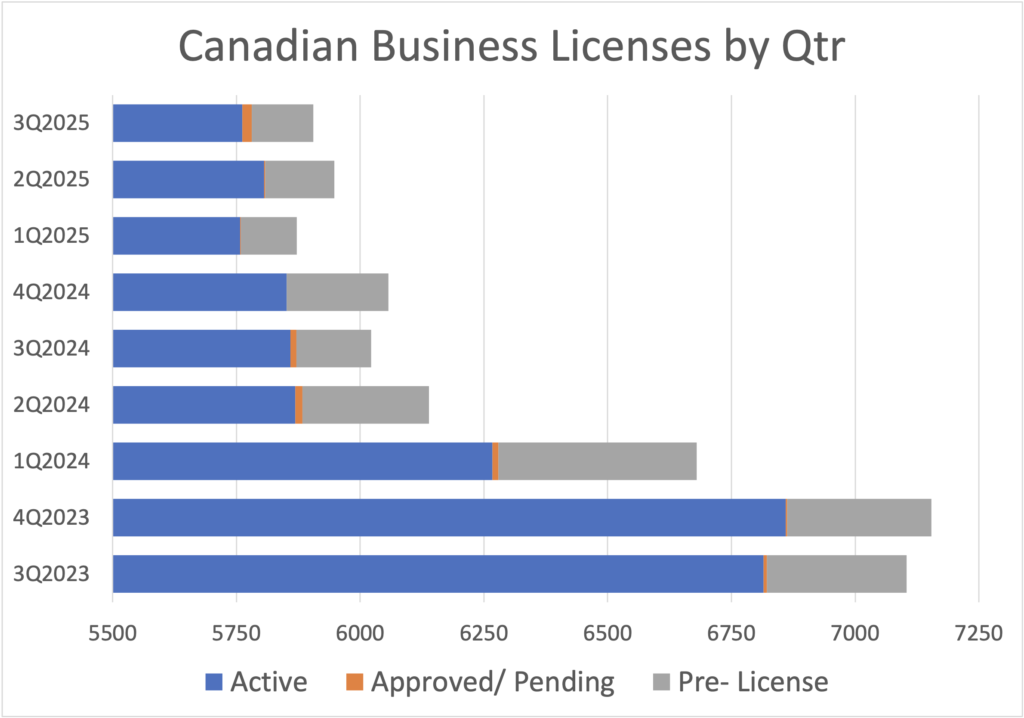

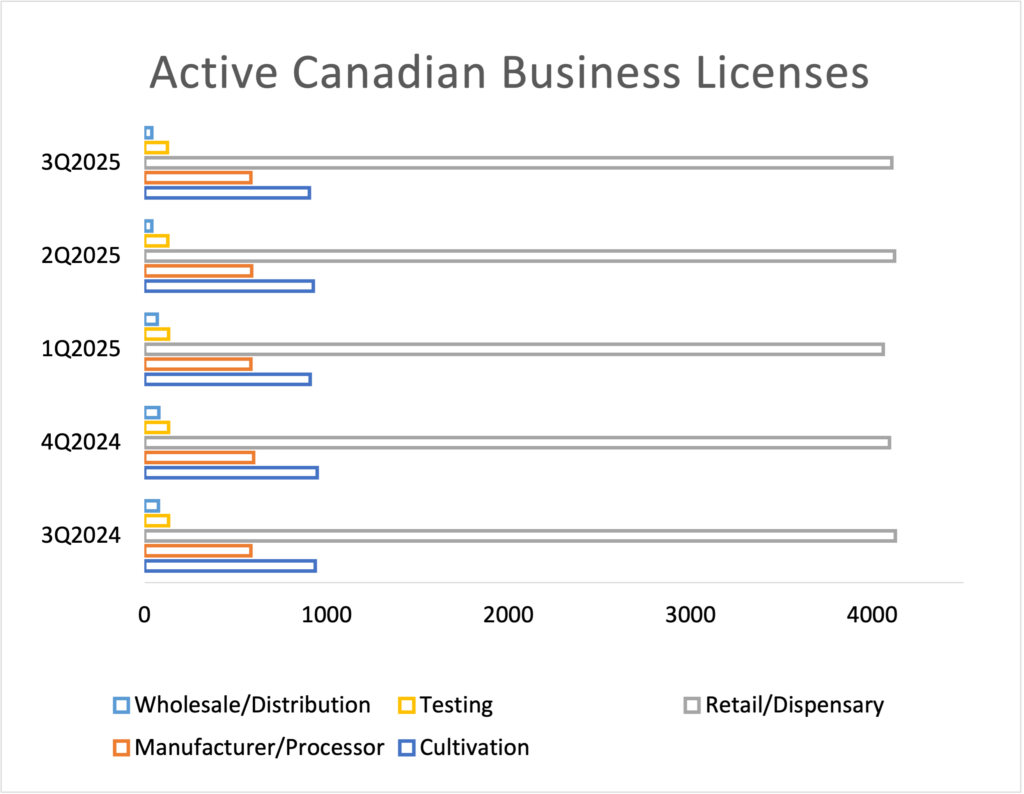

Canada’s market exhibited relative stability in Q3, with active licenses edging down 1% to 5,762. However, this stability caps a two-year decline of 15%, underscoring similar pressures of market maturation and consolidation. The quarter did show a nascent spark in new Canadian applications, though from a historically low base.

This report provides a detailed, section-by-section analysis of the Q3 2025 licensing landscape. It examines national totals, license type dynamics, state and provincial variations, and the indicators of future market growth, culminating in an assessment of the industry’s current trajectory and underlying forces.

United States: Active Licenses in Persistent Decline

The total number of active cannabis business licenses in the United States decreased by 1% in Q3 2025 to 37,555. This modest quarterly drop is part of a more profound, sustained national decline first observed in Q4 2022. The contraction has accelerated over broader timeframes: active licenses fell 2% from the previous six-month period and were 3% lower than the total from twelve months prior. Most strikingly, the national inventory of active licenses has shrunk by 13% over the past two years. This data unequivocally points to an industry-wide shakeout, where market forces, regulatory pressures, and economic realities are reducing the total number of operational entities.

The total number of active cannabis business licenses in the United States decreased by 1% in Q3 2025 to 37,555. This modest quarterly drop is part of a more profound, sustained national decline first observed in Q4 2022. The contraction has accelerated over broader timeframes: active licenses fell 2% from the previous six-month period and were 3% lower than the total from twelve months prior. Most strikingly, the national inventory of active licenses has shrunk by 13% over the past two years. This data unequivocally points to an industry-wide shakeout, where market forces, regulatory pressures, and economic realities are reducing the total number of operational entities.

The Stalling Pipeline: Approved/Pending and Pre-Licensing Activity

The metrics for future market entrants tell an equally sobering story, reflecting diminished growth sentiment.

Approved/Pending Licenses

This category, which aggregates licenses approved but not yet operational in the country’s 23 adult-use markets, fell by 1% in Q3 to 4,363. This marks the fifth consecutive quarterly decline in new license approvals. The slowdown is even more pronounced over longer periods, with the count at the end of September representing a 14% decline from six months ago and a 21% drop from the year-ago period. This sustained reduction in the “ready-to-launch” pipeline suggests that even successful applicants are facing delays in commencing operations, possibly due to capital constraints, local approval hurdles, or strategic reassessments of market conditions.

Pre-Licensing Activity

Defined as new license applications pending approval, this leading indicator of market interest also fell by 1% to 5,218 in Q3. This extends a decline that began in Q3 2024, following a surge driven by New York’s application window. Pre-licensing totals were 5% lower than the previous six months and a substantial 22% lower than a year ago. New York continued to dominate this category, accounting for 88% (4,624) of all applications in review. Despite this single-state activity, the national pre-licensing total is 16% lower than two years ago, a stark indicator of how sentiment has cooled in the post-epidemic era across most markets.

Canada: Stability After a Steep Fall

The Canadian cannabis market presented a picture of quarter-over-quarter stability amidst a longer-term downturn. Active business licenses declined by 1% in Q3 to 5,762, maintaining a steady range around 5,800 for the preceding five quarters. This recent steadiness, however, follows a two-year decline of 15%, exacerbated by a prolonged dearth of new market entrants. A potential shift occurred in Q3, with 19 applications approved or pending and 124 new applications submitted. While this hints at renewed interest, the scale remains muted; the number of applications in review is still 18% lower than a year ago and 56% lower than two years ago, indicating that the Canadian market is consolidating into a stable, if smaller, operational base.

The Canadian cannabis market presented a picture of quarter-over-quarter stability amidst a longer-term downturn. Active business licenses declined by 1% in Q3 to 5,762, maintaining a steady range around 5,800 for the preceding five quarters. This recent steadiness, however, follows a two-year decline of 15%, exacerbated by a prolonged dearth of new market entrants. A potential shift occurred in Q3, with 19 applications approved or pending and 124 new applications submitted. While this hints at renewed interest, the scale remains muted; the number of applications in review is still 18% lower than a year ago and 56% lower than two years ago, indicating that the Canadian market is consolidating into a stable, if smaller, operational base.

Analysis by License Type – Diverging Trajectories

Major License Types

The distribution and performance of license types reveal where consolidation is most acute and where niche growth persists.

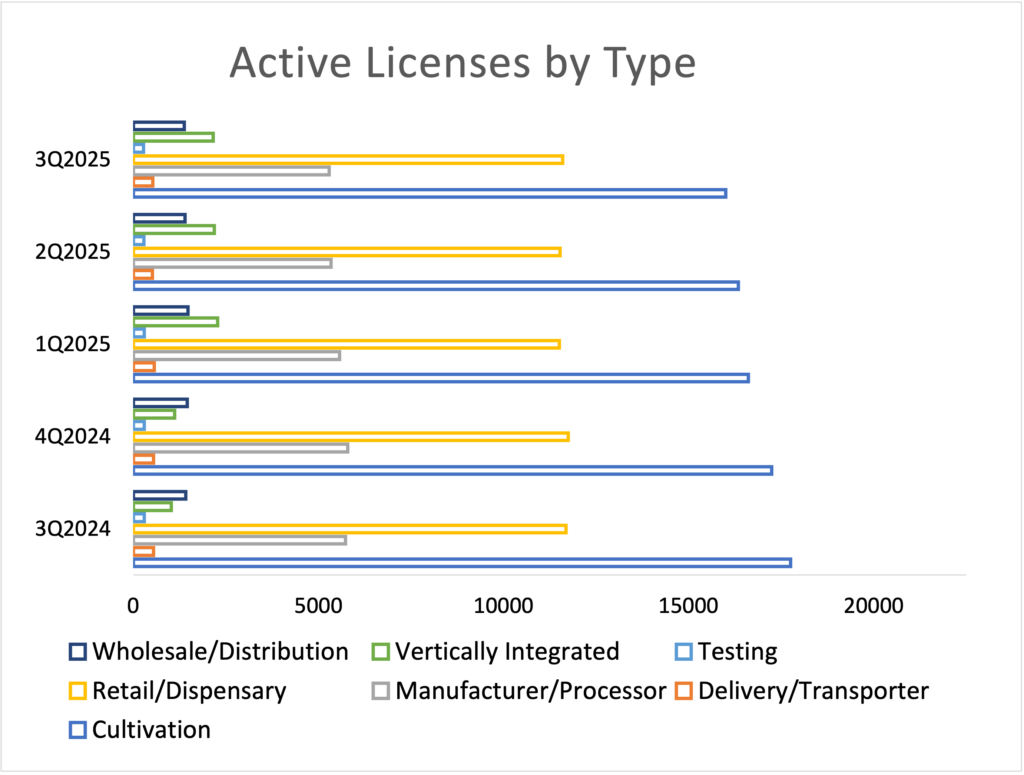

Cultivation and Retail: Together, these categories form the industry’s backbone, comprising 74% of all active U.S. licenses in Q3.

Cultivation and Retail: Together, these categories form the industry’s backbone, comprising 74% of all active U.S. licenses in Q3.

- Cultivation saw active licenses decline by 2% to 16,007, reflecting ongoing production glut and consolidation, particularly in large, established markets.

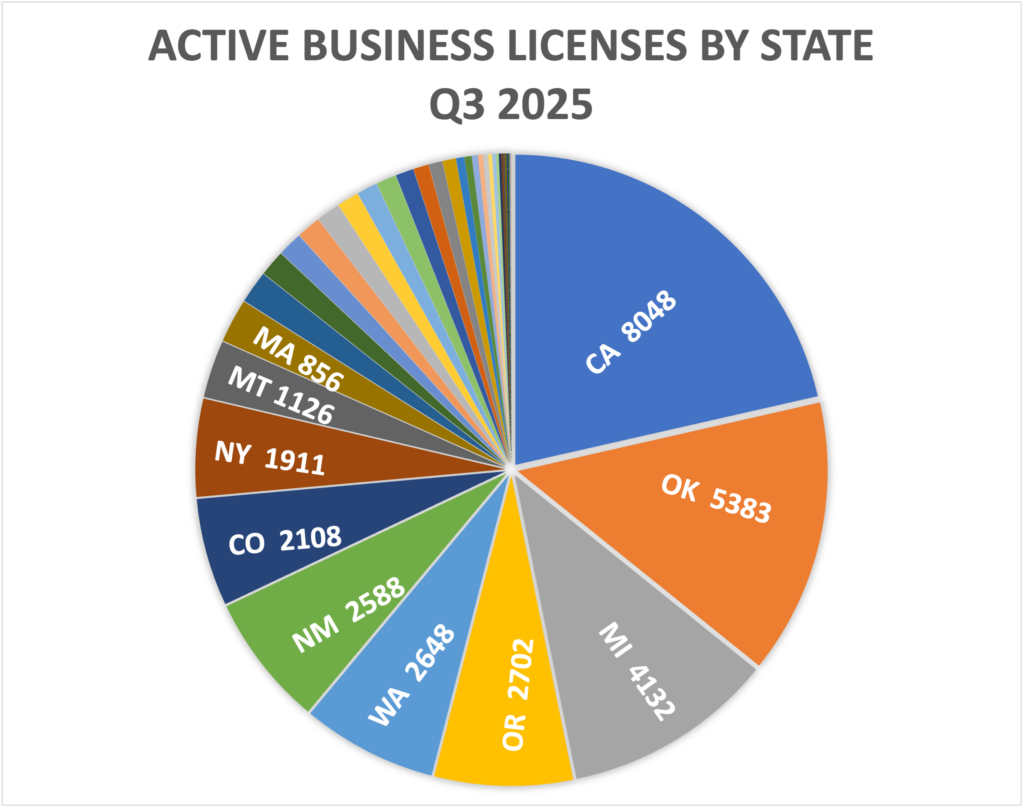

- Retail/Dispensary licenses, in contrast, increased by 1% to 11,601. This marginal growth was supported by new adult-use rollouts in states like Ohio and New York, which offset rationalization in mature markets. Seven states (California, Oklahoma, Michigan, Oregon, Washington, New Mexico, Colorado) accounted for 75% of all active cultivation and retail licenses nationwide.

Manufacturing and Wholesale: These mid-chain segments continue to contract.

- Manufacturer/Processor licenses, the third-largest type, fell 1% to 5,291.

- Wholesale/Distribution licenses fell 2% to 1,376.Both decreases extend a two-year trend of consolidation in these supply chain segments.

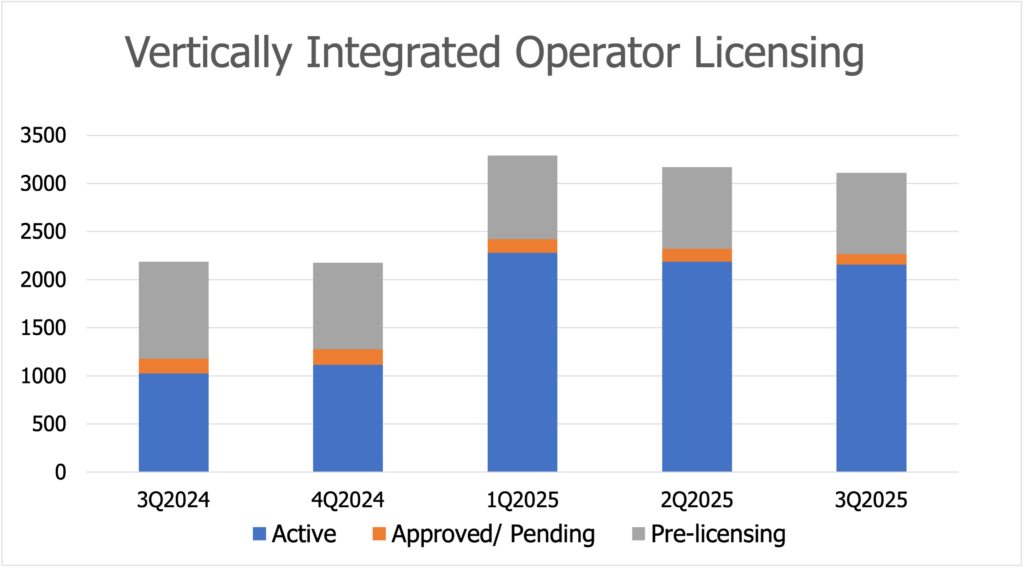

Vertically Integrated Operators: This category exhibited the most dramatic growth over the past two years, more than doubling to a high of 2,279 active licensees in Q1 2025. However, growth has since stalled and reversed, slipping more than 5% in the past six months. Much of the earlier 2025 growth was inorganic, stemming from a one-time regulatory reclassification of nearly 600 multi-license holders in New Mexico as master vertical licensees. Nationally, this category is poised to remain the fourth-largest, with New York working through a backlog of over 800 applications for vertical operations.

Vertically Integrated Operators: This category exhibited the most dramatic growth over the past two years, more than doubling to a high of 2,279 active licensees in Q1 2025. However, growth has since stalled and reversed, slipping more than 5% in the past six months. Much of the earlier 2025 growth was inorganic, stemming from a one-time regulatory reclassification of nearly 600 multi-license holders in New Mexico as master vertical licensees. Nationally, this category is poised to remain the fourth-largest, with New York working through a backlog of over 800 applications for vertical operations.

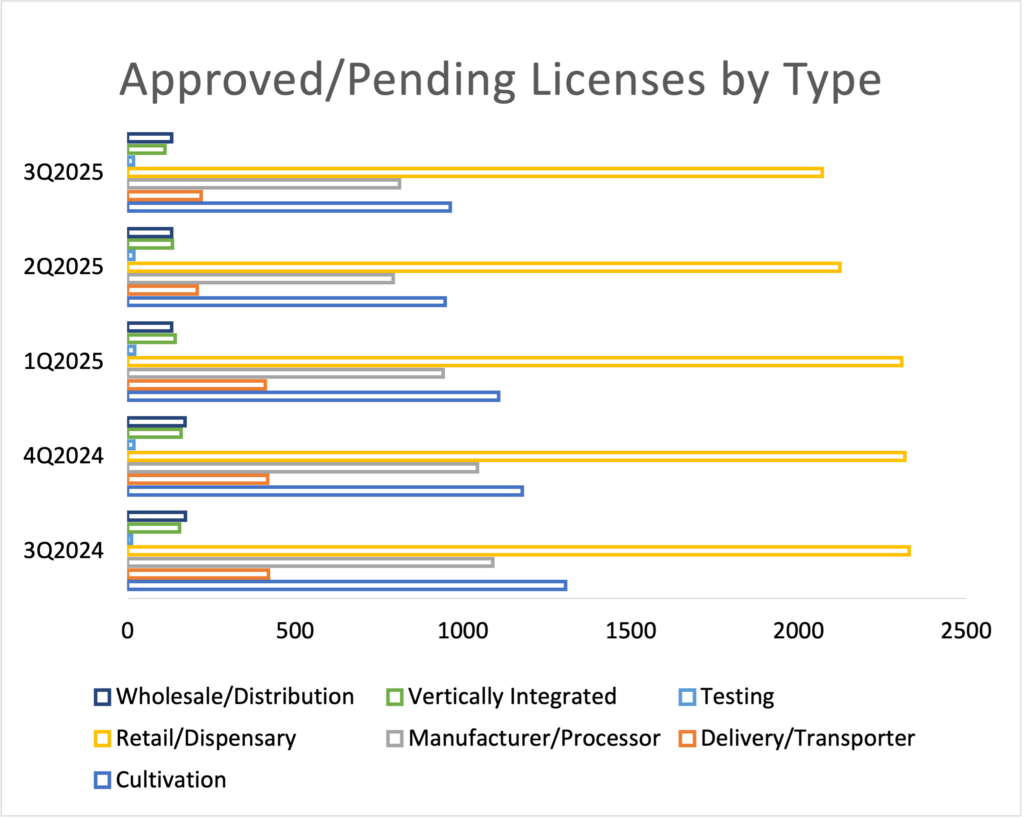

Approved/Pending Pipeline: Two-Year Lows

The near-term pipeline of approved-but-not-operational licenses showed mixed signals:

Cultivation: Ended Q3 with 962 approved/pending licenses, a 2% increase from Q2 but still 26% lower than a year ago. Over two years, cultivation permit approvals are down 27%.

Cultivation: Ended Q3 with 962 approved/pending licenses, a 2% increase from Q2 but still 26% lower than a year ago. Over two years, cultivation permit approvals are down 27%.- Retail: Approved/pending retail permits fell 2% to 2,070, a two-year low, indicating sluggish future store growth overall.

- Supply Chain Bright Spot: Sectors like manufacturer/processors, delivery/transporters, and wholesale/distributors saw stability or growth in new approvals. Delivery/Transporter licenses (the smallest of the three) rose 6% to 219. Manufacturer/Processor approvals rose 2%, though from a level 26% lower than a year ago.

- Testing Facilities: New approvals in this critical sector declined 5% to just 18 nationwide, a concerning dip for quality assurance infrastructure.

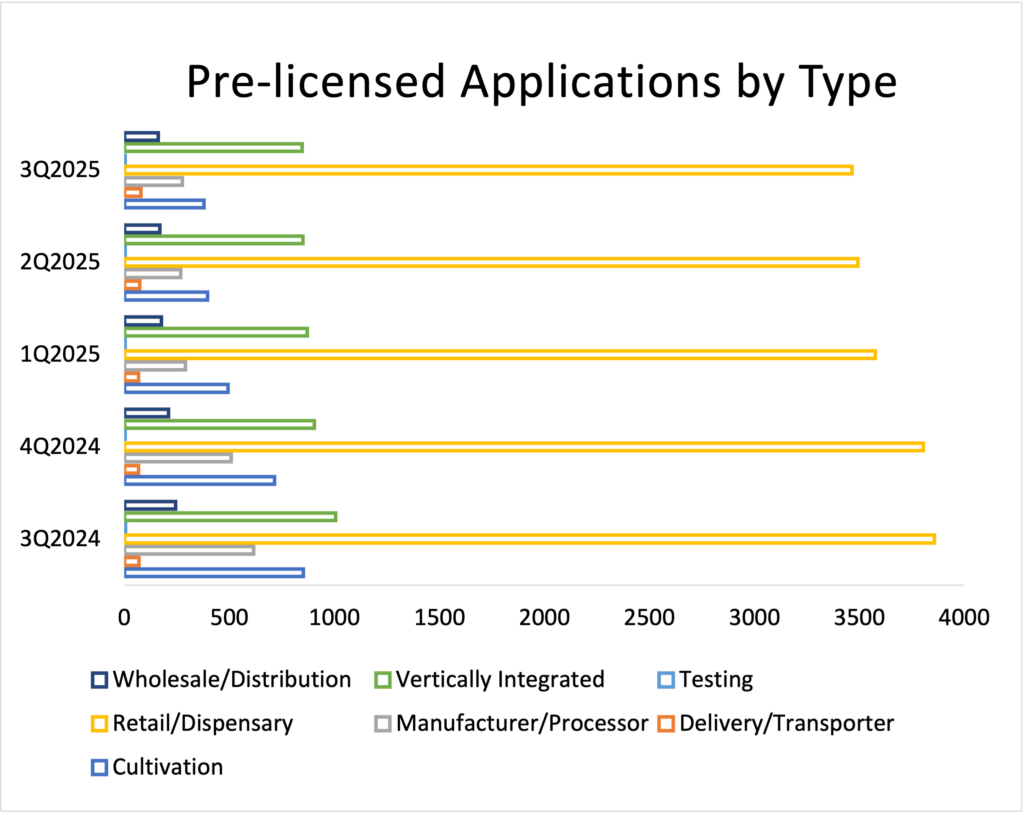

Pre-Licensing Applications: A New York Story

Interest from new applicants (pre-licensing) declined across almost all categories.

Nationally, pre-licensing applications fell 1% to 5,218, the fifth consecutive quarterly decline.

Nationally, pre-licensing applications fell 1% to 5,218, the fifth consecutive quarterly decline.- Delivery/Transporters were the sole major category to see an increase, rising 7% to 77 applications.

- Cultivators experienced the sharpest drop, falling 4%, followed by Wholesaler/Distributors, also down 4%.

- Retail/Dispensary applications remained at elevated levels (3,494, down 1%) due almost entirely to New York’s backlog, which comprises 87% of national retail applicants.

- Vertically-Integrated applications were also dominated by New York, with 828 of the 846 national applications seeking permits in the Empire State.

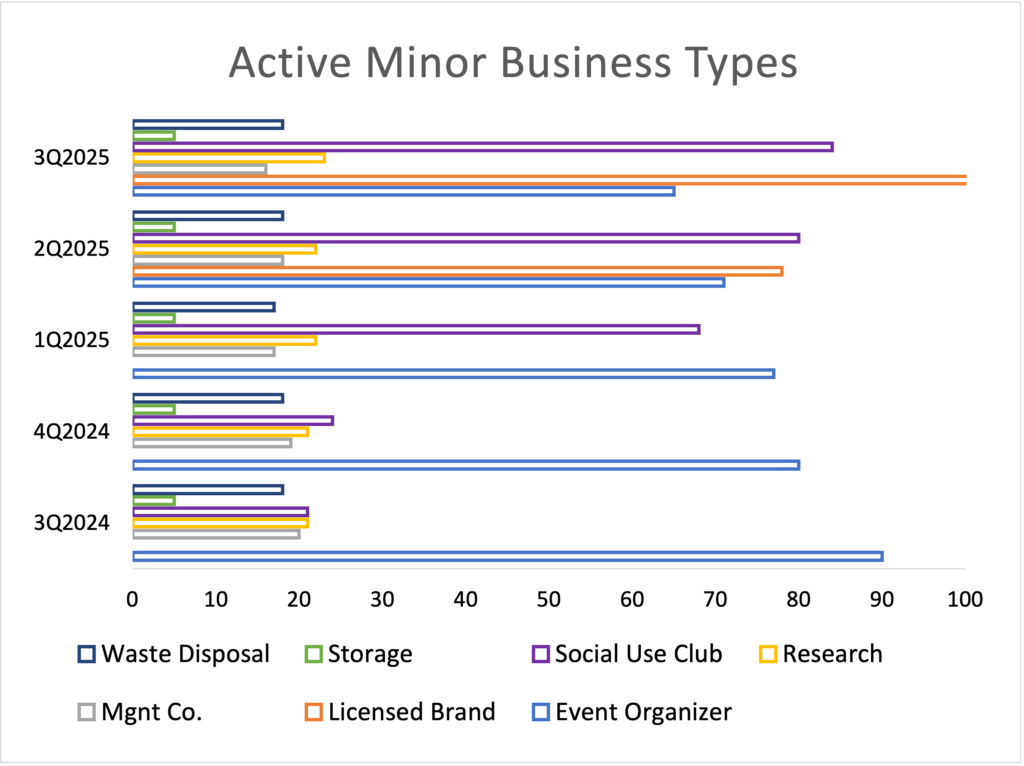

Minor License Types

License types with fewer than 300 active national licenses showed volatile, niche-driven trends:

Activity was mixed, with event organizers declining 8% amid a three-year contraction, while social use clubs grew 5%.

Activity was mixed, with event organizers declining 8% amid a three-year contraction, while social use clubs grew 5%.- Social use clubs have been a standout, increasing 300% in the past 12 months to 84 licensed clubs, driven by policy expansions in New Mexico, Nevada, Colorado, and Michigan.

- The most dramatic growth was seen in New York’s newly designated licensed brand company category, which added 44 new licenses in six months to reach 122 total.

Canadian License Types

The Canadian market showed remarkable sectoral stability in Q3, with no segment varying by more than ±3%.

Retail dispensary licenses remain the largest category at just over 4,100 active permits (a <1% decrease).

Retail dispensary licenses remain the largest category at just over 4,100 active permits (a <1% decrease).- Cultivation (906) and Manufacturer/Processor (584) licenses, the second- and third-largest types, fell 2% and 1%, respectively.

- The wholesale/distributor sector, which collapsed in the first half of the year (-44% to just 39 licensees), appears to have stabilized, albeit at a drastically reduced level.

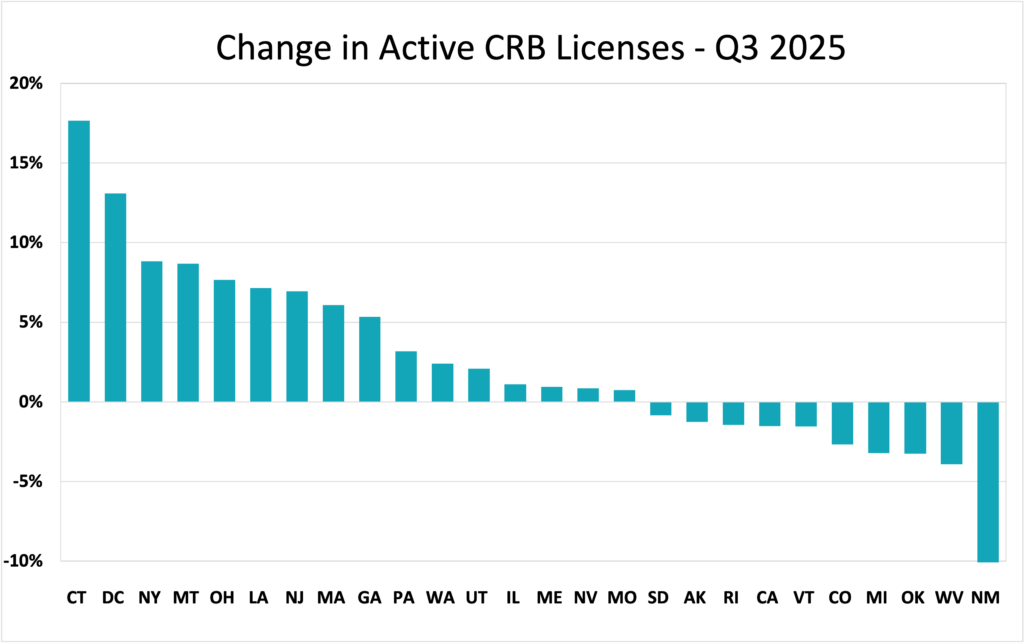

State-Level Dynamics – Consolidation vs. New Market Growth

Established Markets: Contraction and Rationalization

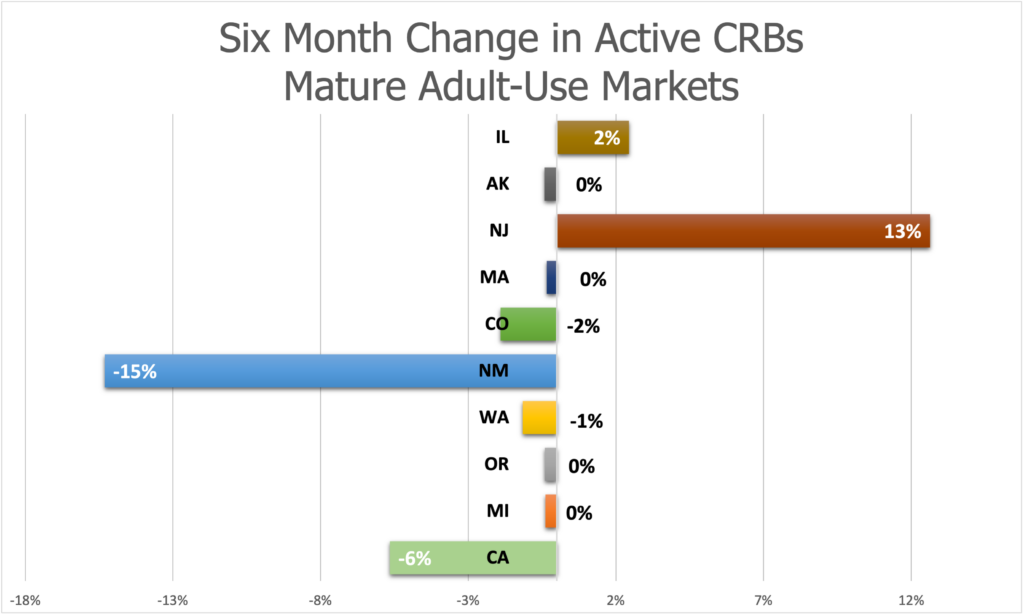

In the eleven established states (with markets two years or older and 500+ operators), license counts declined by an average of 2% over the past two quarters.

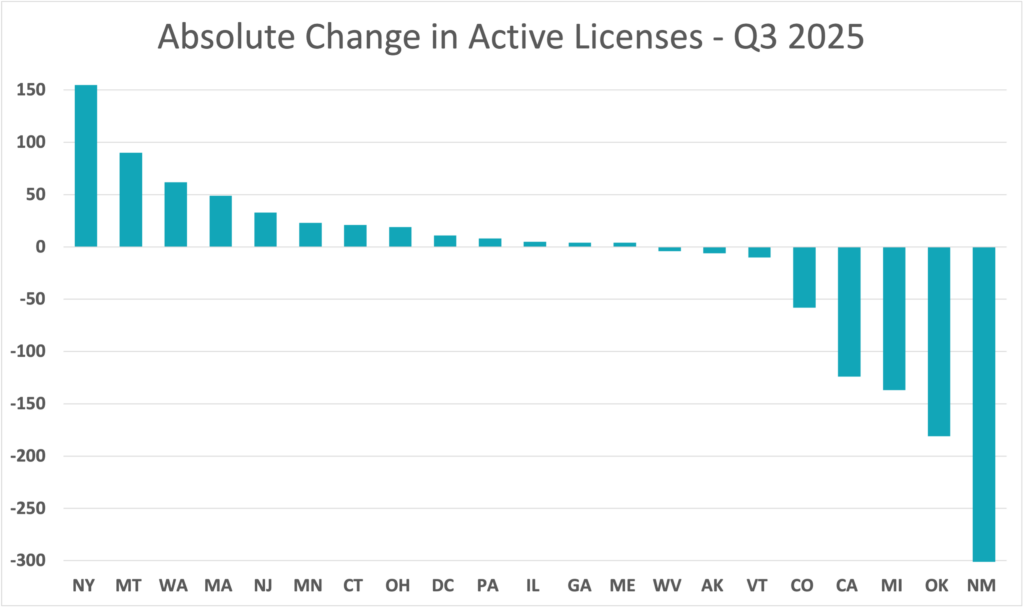

New Mexico experienced the sharpest decline, losing 303 licensees (-10%) in Q3 and shedding 15% of its licensees over the past six months. This reflects a tumultuous adjustment following its rapid, loosely regulated adult-use launch.

New Mexico experienced the sharpest decline, losing 303 licensees (-10%) in Q3 and shedding 15% of its licensees over the past six months. This reflects a tumultuous adjustment following its rapid, loosely regulated adult-use launch.- Oklahoma, under a prolonged moratorium and compliance crackdown, lost 181 licensees (-3%) in Q3. Over the past eight quarters, the state has seen a staggering 53% plunge in active licenses, though it remains the second-largest state market by license count (5,383).

- Michigan, the third-largest U.S. market, lost 137 licenses (-3%), bringing its total to 4,132—an 8% decrease from its Q3 2024 peak.

Growth Markets: Leading the Expansion

Growth was concentrated in newer or expanding adult-use markets.

New York led all large states with a 9% quarterly increase (adding 155 licenses), achieving 71% growth over the past 12 months to reach 1,911 active permits.

New York led all large states with a 9% quarterly increase (adding 155 licenses), achieving 71% growth over the past 12 months to reach 1,911 active permits.

Other states with significant percentage growth included:

- Minnesota: +480% (+28 licenses) in the first year of its adult-use rollout.

- Connecticut: +13% (+21 licenses)

Montana: +9% (+90 licenses)

Montana: +9% (+90 licenses)- New Jersey: +7% (+33 licenses)

- Ohio: +8% (+19 licenses)

- District of Columbia: +13% (+11 licenses)

Overall, 18 of 44 licensed state markets gained licensees in Q3, while 12 states lost licensees. Aside from New Mexico, no state lost more than 4% of its licenses, and nine states experienced growth of 5% or greater.

State-Level Pipeline: Approved/Pending and Pre-Licensing

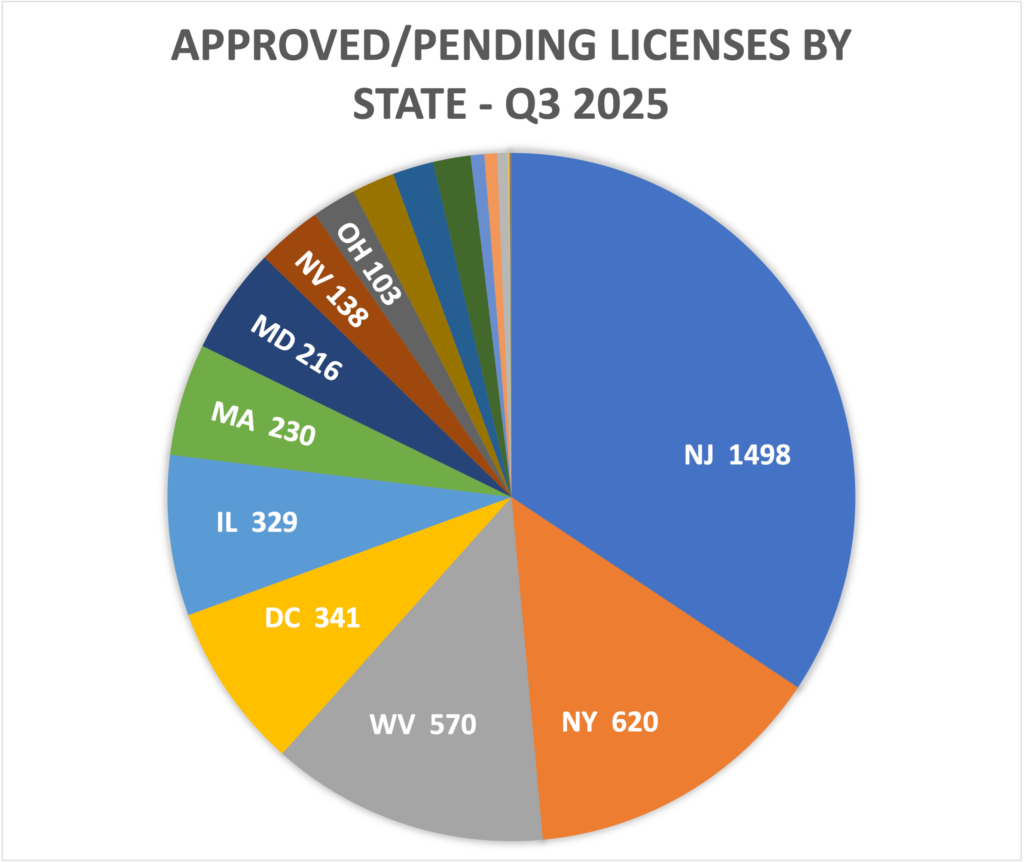

Approved/Pending Licenses:

Approved/Pending Licenses:

- Counts increased in only six states: West Virginia, Massachusetts, New Jersey, Maryland, Maine, and New Mexico.

- Only West Virginia had a notable absolute increase, adding 70 approvals (a 14% rise) linked to its medical-use program rollout.

- The sharpest declines were in New York (-9% to 620), Connecticut, Ohio, and D.C.

- New Jersey holds the most licenses awaiting activation (1,498, virtually unchanged), followed by West Virginia (570, +14%) and New York (620, -9%).

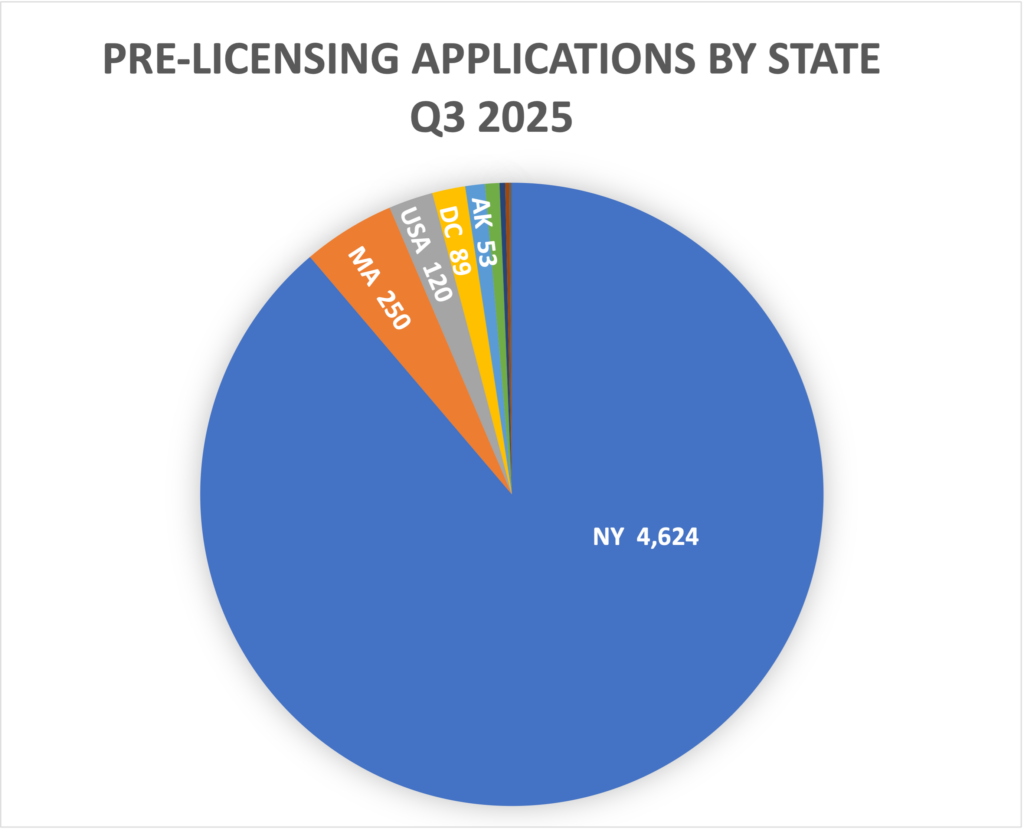

Pre-Licensing Applications:

Interest in new license applications was profoundly weak, with only nine states recording any application activity in Q3.

Interest in new license applications was profoundly weak, with only nine states recording any application activity in Q3.- New York again dominated, with 4,624 applications (a 2% decrease).

- Massachusetts was a distant second with 250 applications (a 10% increase).

- Notably, the established powerhouse California recorded only seven new applications, a situation unchanged for four consecutive quarters, highlighting extreme market saturation and low new-entrant interest in the country’s largest cannabis market.

Conclusions and Market Implications

The Q3 2025 cannabis licensing data paints a clear picture of an industry in a mature phase of its lifecycle, characterized by consolidation, rationalization, and geographic divergence.

- The Era of Hyper-Growth is Over:The multi-year decline in total active licenses across the U.S. and Canada confirms that the land-rush phase has concluded. Markets are now shedding weaker operators, with consolidation most severe in cultivation and wholesale/distribution. This is a natural, if painful, progression toward a more sustainable and efficient industry structure.

- Growth is Now Geographically Specific:National aggregates mask a bifurcated reality. Established marketslike California, Oklahoma, and Michigan are contracting, while newly opened or expanding adult-use states like New York, Ohio, Minnesota, and Connecticut are driving all net growth. The future license count trajectory of the U.S. industry will depend heavily on the pace of additional state legalizations and the execution of rollouts in states like New York.

- Sentiment is Cautious:The fifth consecutive quarterly decline in both approved/pending and pre-licensing applications is a powerful indicator of tempered expectations. Capital constraints, regulatory complexity, and the demonstrated challenges of profitability in saturated markets are causing entrepreneurs and investors to be more selective. The exception—New York’s massive pre-licensing backlog—represents a unique, state-specific gold rush that distorts the national picture.

- Operational Sophistication is Increasing:The growth of vertical integration (despite recent stalling) and the relative strength in supply-chain licenses like delivery and manufacturing suggest a move toward more controlled, efficient, and brand-centric operations. The explosive growth of niche categories like social use clubs and brand licensing in permitted states points to increasing market segmentation and diversification beyond basic plant-touching activities.

- Canada as a Harbinger:The Canadian market, being nationally legal and several years ahead of the U.S., may serve as a precursor. Its steep two-year decline followed by recent stabilization into a smaller, steadier operator base could be the eventual endpoint for maturing U.S. state markets. The Canadian experience underscores that consolidation is not necessarily a crisis but a pathway to maturity.

In summary, the third quarter of 2025 reinforced that the North American cannabis industry is no longer defined by ubiquitous expansion. It is now a story of selective growth, operational efficiency, and strategic consolidation. Success for businesses and investors will increasingly depend on navigating specific state dynamics, leveraging scale or niche advantages, and weathering the ongoing financial and regulatory pressures that are reshaping the licensed landscape. ![]()

Click here to download the Q3 2025 Cannabis Business Licensing Review in PDF format