What a silly question, given that cannabis equities have to stage a quadruple-digit comeback to fully recover from their highs of three years ago. But to be fair, this actually could be the year (of sorts) of cannabis, as almost all legislative activities seemingly remain on hold while representatives take vacations, threaten to vacate speakers, withhold foreign aid and chase dead-end impeachment procedures.

Truth be told, cannabis reform might be the one piece of legislation that has a chance of getting done because it is overwhelmingly popular with Americans and therefore those veritable titans in congress should consider it to be one of the safest votes they will take. Without an obvious downside, politicians should love bills like SAFER, given its deference to the financial services industry and its obvious benefits for people who live in the now 38 states or territories that currently have some form of legalized marijuana.

And with DEA rescheduling (or complete descheduling, which would uncomplicate things) on the horizon, the cannabis train keeps-a-rolling (no pun intended). Whether it’s before or after Election Day, reforms are bound to happen… eventually. The bottom line is that federal marijuana legalization is popular today and will most likely gain in popularity in the next few years. Cannabis legalization and decriminalization at the federal level would be beneficial to consumers, businesses and the federal government, while deterring the black market from advancing its cause. And so we ask the question: what will be the ultimate deus ex machina that solves this problem? We would suggest that the most effective path to the ultimate signing of these bills into law is through the election process.

Which brings us to the State of Florida, where the Supreme Court kept us all in suspense before ruling that adult-use marijuana legalization can be on the November ballot. The lead-up to this decision, which took place on April 1, provided a lift for the CRBs that hold Florida cannabis licenses as they stand a chance to benefit directly from legalized, recreational weed. We will cover this later in the newsletter.

Cannabis-Linked Equities Performance

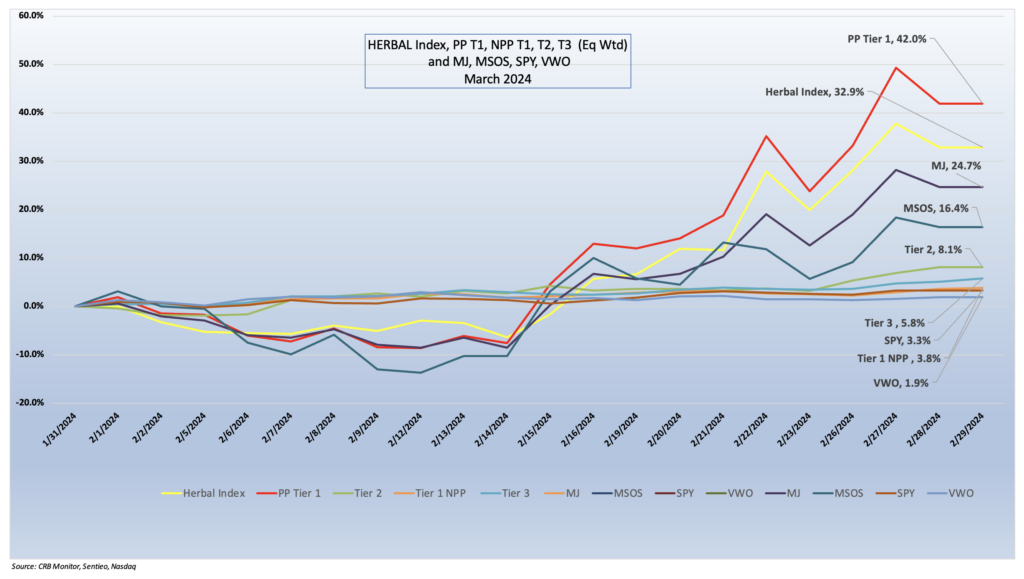

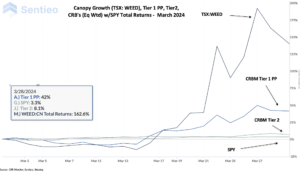

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), had a strong March in a continuation of its positive performance in February. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index. Propelled by triple-digit performance by Canopy Growth Corporation (TSX: WEED), the HERBAL index posted a staggering 32.9% return in March 2024 which largely outperformed the cannabis-themed index space.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), had a strong March in a continuation of its positive performance in February. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index. Propelled by triple-digit performance by Canopy Growth Corporation (TSX: WEED), the HERBAL index posted a staggering 32.9% return in March 2024 which largely outperformed the cannabis-themed index space.

The largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (24.7%) and the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (16.4%), performed well in March following a frustrating February where both were negative. Unlike HERBAL, which is designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching exposure tend to be more sensitive to the U.S. regulatory rollercoaster, which is covered in this newsletter each month. And this time around, the HERBAL index outperformed due to its weight in Canopy Growth, which we will cover below.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs’) due to its current unconventional composition. Since its origin MJ has held a significant percentage of non-Pure Play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally, in 2022, MJ added and maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The U.S. plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It is also important to note that both MJ and MJUS are now operating under a new issuer, Amplify ETFs.

Monthly returns of the self-described (and largest) U.S. plant-touching ETF, MSOS, can also deviate materially from HERBAL’s as well (as it did in March), largely due to its significant holding in CRBs with U.S. marijuana touch-points.

The performance of the recently expanded CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap rebounded in March, spiking by 42.0%. This basket, which is an equally weighted portfolio of the 22 largest Pure Play CRBs (including both U.S. plant-touching and non-U.S. plant-touching cannabis companies), had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space. We will take closer look at some of these below.

The also-expanded CRB Monitor equally-weighted basket of Tier 2 CRBs finished the month behind the soaring Tier 1 CRB basket, but still respectable, posting a +8.1% return for March 2024. Last month, we published an update to our piece on correlations of Pure Play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to, among other factors, the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term, and we would witness this gap narrow over time. This time around the driving force behind the divergence was the performance of a handful of Tier 1 companies let by Canopy Growth Corporation (TSX: WEED), which we will take a closer look at in the next section.

U.S. equities were up again in March as we continued to see positive economic data, as the Fed kept a close watch on inflation and unemployment numbers while announcing the likelihood of three rate cuts in 2024. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a +3.3% return for the month (now +11% YTD) and added to its record-setting gains.

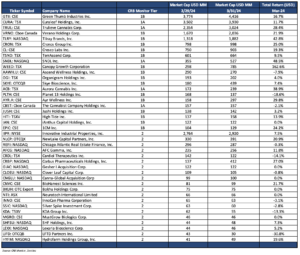

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – March 2024 Returns

CRB Monitor Tier 1

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities posted an uplifting +42% return in March, with reasons to celebrate coming from both the MSO (U.S. plant-touching) group and Canadian (CSA-friendly) CRBs. Investors in the space benefitted from a handful of big winners. Let’s take a look at some of the highlights:

With Florida legalization seemingly in play, performance was “off the hook” in March for the MSO basket. Tier 1B Cresco Labs Inc. (CSE: CL) (+19.3%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (+21.9%), Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+11.7%), Tier 1B TerrAscend Corp. (TSX: TSND) (+9.5%), and Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (+16.7%) all experienced a reversal of fortunes from their dismal February returns. Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) (+28.4%), which has a broad Florida operational presence, stands to benefit significantly from full state legalization, also spiked in February following the news that it seeks to recover more than $100 million in Schedule 280-E taxes that Trulieve paid historically. One of the few negatives in March was Tier 1A CRB The Cannabist Company Holdings Inc. (CBOE Canada: CBST) (-2.1%), in spite of their optimistic fourth quarter financials that were reported on March 13.

Companies that make up the Canadian CRB basket were led in March by Canopy Growth Corporation (TSX: WEED) (+162.6%), which provided some relief for those loyal investors that have hung on through the last few years. What happened? We can see that most of the WEED rally came late in the month (see chart below),

and the impact appeared to come from a confluence of factors. First, in March cannabis investors started buying equities in anticipation of the German government’s passage of a cannabis reform bill that would ultimately make it legal for people to possess cannabis for personal use. And Canopy Growth, which has operations in Germany, stands to benefit from the passage of this bill. Second was the follow-on effect of a mid-March announcement of a special meeting on April 12 where shareholders “will vote on its plans for Canopy USA, a special purpose vehicle that the company plans to set up to house U.S.-based investments, including Acreage Holdings, Wana Brands, and other companies it has pending deals with.” Given the positive sentiment on the upswing over U.S. federal legalization, this announcement was well-received by investors.

Other winners from the Canadian basket included Tier 1B Tilray Brands, Inc. (Nasdaq: TLRY) (+42.8%), Tier 1A Aurora Cannabis (TSX: ACB) (+38.9%), and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (+48.5%), and Tier 1B Cronos Group Inc. (TSX: CRON) (+25.0%) all of which benefitted from positive news across the border and overseas.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies posted a positive 8.1% return for March, which underperformed the equally weighted Tier 1 basket by 33.9%. Typically these two baskets are highly correlated (please see our February 2024 Chart of the Month), and we expect the returns of Tier 1 and Tier 2 CRBs to even out over time. When these two portfolios deviate from one another (as they did in February and then changed places in March) a deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship. But the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can be a losing strategy, so beware!

For the second month in a row, the return of Corbus Pharmaceutical Holdings (Nasdaq: CRBP) (CRBM Sector: Pharma & Biotech) (+27.0%) was strong; with that said, the stock price really took off in February following a Jan. 26 press release in which Corbus announced that data from the first-in-human clinical study of CRB-701 (SYS6002) “Demonstrates Encouraging Safety and Efficacy in Patients with Nectin-4 Positive Tumors.” (Please note that this drug is non-cannabis derived.)

The largest CRB in the basket, Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+7.5%), was up for the second month in a row following optimistic Q4 2023 earnings in February.

Finally, another Tier 2 REIT, AFC Gamma, Inc. (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+11.8%) performed well on the heels of a mid-March announcement that AFCG “has provided a total of $34.0 million in debt capital across two senior secured credit facilities to High End Holdings, LLC and Green Sentry Holdings, LLC d/b/a Sunburn Cannabis…a private, vertically integrated, single-state Florida operator. Sunburn intends to use the proceeds from the credit facilities to refinance existing debt, provide working capital, and build additional cultivation and processing facilities and new retail dispensaries in its business plan.”

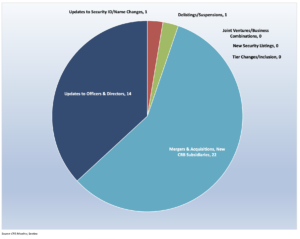

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for March 2024:

Cannabis Business Transaction News – March 2024

CRB Monitor’s securities analysts continue to track the cannabis news cycle, and whenever there is a story that has an impact on our clients’ data we ensure that the CRB Monitor database is updated daily so that it always reflects, as closely as possible, the current state of the cannabis ecosystem. Here are some of the highlights from March 2024:

Tier 1B CRB Vext Science, Inc. (CSE: VEXT) issued a press release in March announcing that it “has completed the acquisition of a cannabis dispensary in Columbus, Ohio as part of the previously disclosed acquisition of Appalachian Pharm Processing, LLC, together with its subsidiaries and affiliated companies.” As part of the closing, Vext will pay to CannAscend Ohio Columbus LLC additional aggregate consideration of approximately $2,879,322 plus approximately $148,000 for certain pre-closing tax liability of the Columbus Dispensary, subject to adjustments based on pre-closing operations. The Columbus Dispensary is called Strawberry Fields and located at 2950 E. Main Street, Columbus, Ohio. On Feb. 2, 2024, Vext received regulatory approval from the Ohio Department of Commerce to transfer ownership of the Columbus Dispensary to Vext. With this new acquisition, Vext’s active license count is now 14 with operations in Ohio, Arizona and Oklahoma.

Also in March, Green Thumb Industries Inc. (CSE: GTII), Tier 1B MSO and the largest CRB by market capitalization, issued a March press release announcing “the opening of its 15th retail location in Florida and 92nd nationwide, RISE Dispensary Dunnellon…The new store will offer medical cannabis patients a range of high-quality THC and CBD products, including RYTHM premium flower and full spectrum vapes, Dogwalkers pre-rolls, Good Green flower, and &Shine flower, pre-rolls, vapes and chews…The menu will feature a special Brownie Scout donut, named after the popular RYTHM flower strain.” Green Thumb’s expansion in Florida comes on the heels of the Sunshine State’s progress toward adult-use legalization, which will be a referendum question on the November ballot. With this acquisition, Green Thumb’s active/pending license count sits at 101 (the new Florida business operates under the existing license).

Tier 1B Canadian CRB High Tide Inc. (TSXV: HITI) was active in March, making several moves to expand its cannabis operations. On March 4, the company issued a press release announcing the opening of its second Canna Cabana retail store located in Mississauga, Ontario. With this (and a few other) openings in March, High Tide’s license count has expanded to 214 in five Canadian provinces, with operations in Australia as well.

Also in March, Wakefield, Mass., Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) issued a March press release announcing that it “has signed a deal to acquire Northern Green Canada (“NGC”), a vertically integrated Canadian licensed cannabis producer focused primarily on expanding in the international market through its EU-GMP certification. NGC also partners with Canadian GACP cultivators to produce and distribute finished cannabis products to both the domestic and global markets.

NGC is one of the few Canadian cultivators with EU-GMP certification. As such, NGC has consistently supplied high THC, non-irradiated flower to the German market, which is expected to see exponential growth following the recent removal of cannabis from the narcotics list. NGC is also increasingly supplying Australia and New Zealand, the world’s fastest-growing cannabis markets.”

This European expansion is no accident given the recent revelations out of Germany. Like the aforementioned Canopy Growth, CURA will be riding the German wave as legalization there becomes a reality this April. One of the industry leaders, Curaleaf holds, directly and through its subsidiary businesses, 131 cannabis licenses and operates in six countries.

Finally, Tier 1B MSO Ayr Wellness Inc. (CSE: AYR.A) announced in a March press release the opening of its relocated AYR Cannabis Dispensary Tallahassee. Similar to the actions of Green Thumb, Ayr is undoubtedly looking ahead to the November elections, after which a victory could mean a windfall of revenues in the future. At present, Ayr Wellness holds, through its subsidiaries, 78 licenses that are in active status or are pending approval across seven states in the U.S.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Mountain Valley MD Holdings Inc. | CSE: MVMD | Tier 1B | Mountain Valley MD Provides Business Update, Appoints New CFO |

| RushNet, Inc. | OTC Pink: RSHN | Tier 1B | Names Arizona Businessman Michael Cunha as Chairman and Chief Executive Officer (RUSHNET INC) |

| Neptune Wellness Solutions Inc. | TSX: NEPT | Tier 1A | Appoints Interim President and CEO and Interim COO (NEPTUNE WELLNESS SOLUTIONS INC) |

| Decibel Cannabis Company Inc. | TSXV: DB | Tier 1A | Decibel Announces Retirement of Paul Wilson as CEO |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Vitana-X Inc. | OTC Pink: VITX | Moved to Watchlist | Tier 3/CBD – Pharma & Biotech |

| Horizons US Marijuana Index ETF | Cboe Canada: HMUS | Deleted | Tier 1B/ ETF – Cannabis-Themed |

| Subversive Cannabis ETF | CBOE: LGLZ | Deleted | Tier 1B/ ETF – Cannabis-Themed |

| Eastwood BioMedical Canada Inc. | TSXV: EBM | Moved to Watchlist | Tier 3/Pharma & Biotech |

| Blockchain Solutions, Inc. | OTC Pink: BLCS | Moved to Watchlist | Tier 3/IT Services & Software |

Cannabis News: Regulatory Updates

The cannabis regulatory saga rolls on, and the CRB Monitor news team has been in hot pursuit of all the relevant stories. From a legal perspective, cannabis is truly unique, given that many states have legalized it at least for medical use while the federal government continues to tag marijuana as a dangerous narcotic. And what is “medical marijuana,” other than one way of classifying something that is virtually indistinguishable from a version that is called “adult use.” We are hard-pressed to find a parallel anywhere else, where there are, in the eyes of the law, both a medical and a recreational use for the same drug, where the main difference is the rate of sales tax (and in some cases, the allowable quantity that can be dispensed).

One might even argue (and this is nothing new) that the only purpose of medical marijuana is to provide a runway for the legalization and mainstreaming of adult use marijuana. This makes perfect sense, given the significant revenues that are generated as adult use is approved in one state after another. And so we remain poised on the edge of our seats as federal regulators consider things like rescheduling (or even descheduling), cannabis banking reforms, and dare we say, legalization at the federal level.

With that said, here are some highlights from the cannabis regulatory news cycle.

Our CRB Monitor news team has been working overtime to bring our readers only the best-in-class news regarding the cannabis industry, and this story is no exception. We reported in our February 2024 newsletter about Trulieve Cannabis Corp. (CSE: TRUL)’s windfall tax refund of $113 million, which was related the Florida-heavy MSO’s historical taxes paid under IRS rule 280E. In a March article entitled “Questions Remain About Trulieve’s Supposed $113M Tax Win” CRB Monitor reported:

“Trulieve announced during its fourth quarter call on Feb. 29, that it had received $113 million in tax refunds after filing amended claims for the years 2019-2021. During that same call, the company also reported $527 million in net losses for all of 2023, with $33 million in net losses coming during the fourth quarter. Trulieve claimed $143 million in refunds from the federal government and another $31 million from state governments. So far, they received $62 million in the fourth quarter and an additional $50 million in the first quarter of 2024. The company received a rejection of $1.2 million of their claims, leaving about $60 million in remaining refund claims from their amended 2019-2021 filings.”

Not so fast, says our news team, as there is a possibility that this refund might not stick. According to the article, “There is currently no guarantee that the Florida-based cannabis giant has an iron-clad tax strategy to get around 280E restrictions, and the company stated in its quarterly filings that it expects to be audited by the IRS over this tax position.” And until this case has been fully reviewed, the government will hold onto Trulieve’s refund. The article quotes Jesse Hubers, senior manager at tax accountant HBK:

“The government will just hold it until whatever the contingency that’s implicated by that protective claim is removed… If you’ve got deep enough pockets, a tax opinion letter might be the way to go. I think most of these big MSOs are all going to be doing this. They’re not gonna be able to find debt out there with terms on par with the government’s IRS interest rates. The debt market is just much, much tighter on cannabis, and the IRS doesn’t differentiate their interest rates depending on who the taxpayer is.”

Next, from the “no surprises” file, in March it was reported that Glenn Youngkin, Virginia’s Republican governor, vetoed a bill “that would have finally legalized adult-use marijuana sales in the state.”

It looks like Gov. Youngkin takes a view that differs from the majority of Americans. In the words of this report:

”Virginia legalized adult-use cannabis in 2021 with a bill signed into law by then-Gov. Ralph Northam, a Democrat. However, that law required state legislators to reenact portions setting up regulated sales. In the years since, a partisan logjam led by Youngkin has kept adult-use legalization bottled up, encouraging the emergence of an illicit market that some estimate is worth $3 billion. Medical marijuana sales are legal in the state, albeit under relatively tight restrictions that limit business opportunities to one operator per region. Those licenses are held by marijuana multistate operators.

This year, the Democratic-controlled state Legislature passed a bill legalizing recreational sales by 2025, albeit without a veto-proof majority.” And Youngkin spoiled everyone’s fun with his veto. Here is a quote from the Governor, which should provide some insight into his thought process: “The proposed legalization of retail marijuana in the Commonwealth endangers Virginians’ health and safety,” adding that other states that have legalized recreational cannabis sales are following a “failed path.”

Next we turn to the 50th state, as it was reported in early March that Hawaii’s Senate “overwhelmingly approved a bill to legalize adult-use marijuana retail and cultivation. Senate Bill 3335, according to Honolulu Civic Beat, now goes to Hawaii’s more conservative House, where legalization efforts have been thwarted the past few years.”

According to the report, “Under SB 3335, legalization would go into effect on Jan. 1 2026. Provisions include:

- Establishing the Hawaii Hemp and Cannabis Authority, overseen by the Hemp Cannabis Control Board, to regulate marijuana and hemp businesses.

- Creating a social equity program.

- Imposing a 14% tax on cannabis.

- Possession up to 1 ounce of flower and 5 grams of concentrates.

- Personal cultivation up to six plants and storage up to 10 ounces of marijuana.

- Establishing a DUI law, even though marijuana can be detected days after consumption.

- Recriminalizing possession up to 3 grams for those younger than 21.

- Creation of a cannabis enforcement unit within the Department of Law Enforcement and the addition of personnel to a drug nuisance abatement unit.”

Now from the “hope springs eternal” file we turn to Germany, where it was reported in March that the German government “officially signed into law a bill to legalize marijuana nationwide with the reform set to take effect next week.” According to the Marijuana Moment article:

“Bundesrat President Manuela Schwesig signed the legislation on Wednesday, the last step to enactment. Usually German Federal President Frank-Walter Steinmeier would sign legislation, but because he’s currently away on vacation, that responsibility was handed down to the head of the legislative chamber representing individual states.”

The significance of Germany legalizing marijuana cannot be understated particularly while the United States continues to drag its heels with legislative reforms. And as Germany begins its implementation, it is likely that CRBs from the west will step up their game there. In a related story (and detailed above), Canadian CRB Canopy Growth Corporation (TSX: WEED) is well-positioned for success in a post-legalization Germany. In the words of the March 22 press release on Canopy’s website:

“In addition to the cultural significance of Germany’s cannabis legalization progress, these changes present a unique opportunity for Canopy Growth to expand its commercial presence in the country through the German-based and world renowned Storz & Bickel vaporizer brand, as well as the Company’s medical cannabis product offerings through Canopy Medical which collectively position Canopy Growth as a top three player in the German cannabis industry.”

Finally, as reported by our CRB Monitor news team, the state of New York (which has been nothing short of a minefield for the legal cannabis industry) approved 114 new cannabis licenses in March 2024. According to the article, “The (Cannabis Control Board) approved 114 new adult use licenses, bringing the total to 223, excluding conditional use licenses. New licenses included 45 retailers, 31 microbusinesses, 14 cultivators and 14 processors.”

To those of us close to the action, New York’s recreational cannabis program has been a veritable hot mess following its launch three years ago on March 31, 2021. And since that time, the illicit market for marijuana has thrived, particularly in New York City. An article published by PBS highlights the risks to consumers of purchasing weed from unlicensed CRBs, which comes from the lack of controls and regulatory oversight. This can result in the presence of unwanted toxins and inconsistent levels of THC in the products.

With that said, the issuance of these new licenses comes with additional legislation that will take new steps to remove the illicit market from the big city. On that note, the CRB Monitor article goes on to say:

“The CCB also approved new regulations that would solidify the enforcement process when the Office of Cannabis Management goes after unlicensed cannabis shops. The new rules were presented last year in response to the rampant spread of unlicensed pot shops in and around New York City. They establish OCM’s ability to cite illicit businesses, hold administrative hearings, subpoena witnesses, administer oaths during those hearings, and issue final orders resulting in punitive actions against licensing scofflaws.”

CRBs In the News

The following is a sampling of highlights from the March 2024 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining Marijuana-Related Business and its update Defining Cannabis-Related Business.