It’s been 10 years since the U.S. Department of the Treasury’s Financial Crimes Enforcement Network, better known as FinCEN, has provided guidance to financial institutions on how to legally serve the illegal cannabis industry. By most accounts, the rules have been helpful, but work needs to be done to encourage more banks to provide services and reduce costs to businesses.

FinCEN released its guidance, “BSA Expectations Regarding Marijuana-Related Businesses,” on Feb. 14, 2014, in response to an August 2013 memo written by then-Deputy Attorney General James M. Cole, widely known as the “Cole Memo.”

The Cole Memo, while reiterating that cannabis is an illegal Schedule I narcotic under the Controlled Substance Act, acknowledged that more states were legalizing cannabis, and DOJ attorneys and law enforcement needed to prioritize how to enforce the law. Among the eight priorities were:

- Preventing marijuana revenue from going to criminal enterprises

- Preventing state-authorized marijuana activity from being used as a cover for trafficking other illegal drugs or activity

The FinCEN guidance gave banks, credit unions and other financial institutions rules for when to file Suspicious Activity Reports (SARs) and specific money laundering red flags to monitor to comply with the Bank Secrecy Act (BSA). And although Attorney General Jeff Sessions rescinded the Cole Memo in 2018, FinCEN and the financial services industry have continued to use the guidance.

Saphira Galoob, executive director of the Cannabis Financial Industry Group, said that but for the FinCEN guidance, bankers “wouldn’t have the recipe or appetite to get into the cannabis space.”

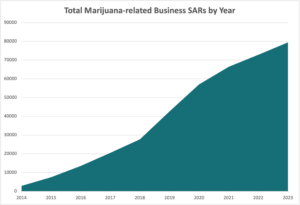

More than 389,000 SARs reports since 2014

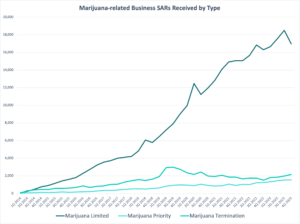

Because cannabis business income is derived from federally illegal activity, bankers are required to file SARs. The FinCEN guidance describes three types of SARs that financial institutions serving the industry must file:

- “Marijuana Limited” – Stating that upon their due diligence, the marijuana-related business does not raise any red flags as described in the Cole Memo and is compliant with banking regulations.

- “Marijuana Priority” – A marijuana-related business may have violated banking or red flag rules and further investigations are being conducted.

- “Marijuana Termination” – A financial institution has terminated an account because the customer has violated banking rules or raised red flags. It also is used if the institution has decided it doesn’t want to serve marijuana companies for business reasons.

The Treasury Department last week released SARs data through 2023, which shows reporting has steadily increased as more states have legalized adult- and medical-use marijuana. When the FinCEN guidance was issued, only 20 states had a legal marijuana program. Today, 42 states allow for some level of THC consumption beyond hemp-derived cannabinoid use.

At the end of 2023 a total 389,565 SARs were filed since 2014, according to the Treasury Department. A total 79,397 were filed in 2023, an increase of 6,566 over 2022. In 2014, there were only 2,863 SARs filed.

The vast majority of them, 88% for the last two years at least, have been “limited” filings. A total 69,641 were Limited SARs in 2023. Termination SARs numbered 7,778.

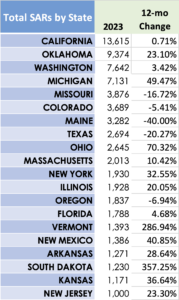

Last year, the three states with the most SARs filings were California (13,615), Oklahoma (9,374) and Washington (7,642).

California, the first state in the nation to legalize medical marijuana and which legalized adult use in 2016, had a less than 1% increase from 13,519 filed in 2022. In 2014, California institutions filed only 627 SARs.

Oklahoma’s SARs jumped by 23% (1,759 reports) in 2023 from 2022. In 2018, when it legalized its medical program, there were only 576 SARs, which nearly tripled to 1,672 in 2019. A mere 24 were reported in 2014.

Washington was one of the first states to legalize adult use in 2012, but sales didn’t start until July 2014. That year, the state’s financial institutions submitted 364 SARs. The next year, following the FinCEN guidance, SARs nearly quadrupled to 1,392. While SARs reporting has steadily increased, the growth began to slow down in 2021. Its 2023 total reports grew by just 3% over 2022.

Number of active depository institutions is still questionable

While the guidance appears to have encouraged more banks and credit unions to work with cannabis companies, how many are actively providing depository services is still debated within the industry.

Zane Gilmer, a partner at Colorado law firm Stinson LLP who has been helping banks and credit unions set up depository and lending programs since before the FinCEN guidance said it has “unquestionably” helped these institutions provide services to the cannabis industry. However, the guidelines don’t say how to implement a program or provide a “stamp of approval.”

“The only conclusion you can make is it helped open the doors a little bit,” Gilmer said.

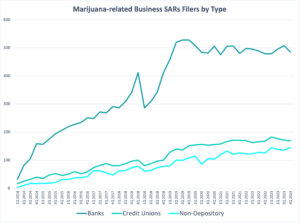

The number of financial institutions – including banks, credit unions and non-depository institutions — that have actively filed Limited or Priority SARs has increased from only 54 in the first quarter 2014 to 799 in the fourth quarter 2023, according to Treasury Department data.

But industry experts don’t think there are that many institutions actively serving cannabis businesses because there’s wide interpretation on when SARs should be filed, and many Termination and Priority SARs are filed by banks that don’t want to serve the industry at all.

“While it is fair to consider DIs (depository institutions) that file Limited SARs as knowingly and proactively banking MRBs, it may be inaccurate to assume DIs filing only Priority SARS are doing so,” wrote CRB Monitor CEO Steven Kemmerling in a 2020 blog post. “Oftentimes, Priority SARs are filed by DIs that are not willing to bank with MRBs, but the relationship is not terminated simply because of red flags or investigations. Priority SARs often are an indication that a DI does not proactively bank marijuana.”

Kemmerling added that some banks may make exceptions to serve larger account holders or maintain relationships, but they are not “proactively or meaningfully serving the industry.”

Most importantly, regulators have not taken “harsh” action against institutions serving the industry, said Gilmer. He said he wasn’t aware of any shutdowns or fines, but there have been BSA/AML consent orders against banks for not implementing the guidelines.

“If you are going to do these programs, you need to have these structures in place,” he said.

Paul Dunford, co-founder at Green Check Verified, said the guidance provides a strong framework to help bankers navigate the BSA’s money laundering provisions. He said FinCEN did “a phenomenal job creating something out of nothing.”

Bankers focus on whether the risk of being shut down for serving the growing industry is worth the reward.

“Yes, there is risk. But in practice, no financial institution has had their charter revoked for banking cannabis,” Dunford said.

Rodney Hood, former chairman of the board of the National Credit Union Administration, who left the regulatory agency earlier this year, said the guidance has successfully helped to open up banking to the cannabis industry.

“No credit union that has followed the FinCEN guidance has been shut down,” Hood told CRB Monitor News. “The FinCEN guidance that’s there, it’s worked.”

Financial institutions are also required to conduct extensive and on-going, “know your customer” due diligence. This includes verifying licensing; understanding the customer’s normal business activity; and monitoring for suspicious activity, red flags and adverse information.

All this work often leads banks and credit unions to charge their marijuana-related customers higher fees than for average business customers.

However, Gilmer said he’s seeing fees coming down across the country for a few reasons. He said as new banks enter the cannabis market, they need to be more competitive. Some that offer loans will have lower deposit fees. And as new states legalize, banks with branches in multiple states can offer lower fees because of economies of scale. National banks are also getting into the cannabis market.

“All are pushing the deposit fee model down from where it used to be even four years ago,” Gilmer said.

Still more work to be done

While the current guidance has helped provide a pathway for cannabis banking, industry experts said more work needs to be done. Even state governments have had challenges banking their tax and fee revenues. And although declining, the costs for compliance monitoring remain high.

The guidance also doesn’t define marijuana-related businesses. As a result, some bankers choose to limit their risk exposure and compliance work by not serving plant-touching businesses. However, they are willing to serve cannabis-business suppliers, landlords, professional service providers and other companies whose revenue is a step or two removed from cannabis sales.

Hood said there is still a lot of uncertainty that makes credit unions cautious. He said they wonder, “What will happen if I make one mistake?”

Sources agreed the SAFER Banking Act could lead to more informed guidance that would be helpful for industry bankers by closing gaps in the FinCEN guidance. As it’s currently drafted, the legislation would require the Federal Financial Institutions Examination Council, a formal interagency council that serves several banking regulators, to create exam guidelines that would serve as a rubric on how to consistently evaluate cannabis customers.

“Getting that exam guide would give so many more people comfort,” Dunford said.

The guidance may end up being more complicated, Galoob said, but current cannabis bankers might be okay with that. They don’t want new participants that implement compliance “willy-nilly” to get a free pass, she said. They want “high quality” servers in the market.

Galoob would also like to see more efficient sharing of data between the banking industry and regulators so that banks could find out quickly when a cannabis business loses its license.

Still, the county’s biggest banks might not jump into the cannabis market, even if SAFER passes. At a recent Senate Banking Committee hearing, none of eight chief executives who testified raised their hand in support of the SAFER Act.

“In my view, the reason we don’t see wide-scale cannabis banking is they know they have to go through all this compliance stuff,” such as hiring knowledgeable staff, Gilmer said. “Institutions will have to evaluate, at that point, is there any reason to get into the space besides the deposit side.”

He said SAFER may move the needle in terms of financial institutions entering the cannabis industry, but, “It won’t be a huge landslide.”

Rescheduling marijuana from Schedule I of the CSA to Schedule III, which the FDA is now considering, may also help open up banking, even though marijuana would still not be federally legal.

When Congress legalized hemp in 2018, banking regulators said financial institutions no longer needed to file Schedule I SARs for hemp businesses. Dunford said he hopes FinCEN would do the same thing for marijuana. Rescheduling may also increase credit card services, he said.

But Gilmer isn’t as optimistic that rescheduling will help much, especially for adult-use markets.

“I don’t think there’s an easy silver bullet,” Gilmer said. “The only one that would exist is descheduling. Anything short of that would shift the conversations, they’re not eliminating them.”

Cannabis industry not going away

As the federal government contemplates loosening the laws around marijuana and banking, the industry continues to grow and become more entwined with the broader economy. Currently, Ohio, Maryland and Alabama are working to launch their legalized adult-use marketplaces, while New York is finally on the road to expansion. Meanwhile, nine states may legalize marijuana commerce this year or expand to adult use.

“As one of the fastest growing industries for several years running, no business is immune from being caught up in the “ecosystem of cannabis,” Galoob said.

“Cannabis is everywhere. We don’t have to turn a blind eye,” she said. “Everybody in the economy is connected to cannabis.”